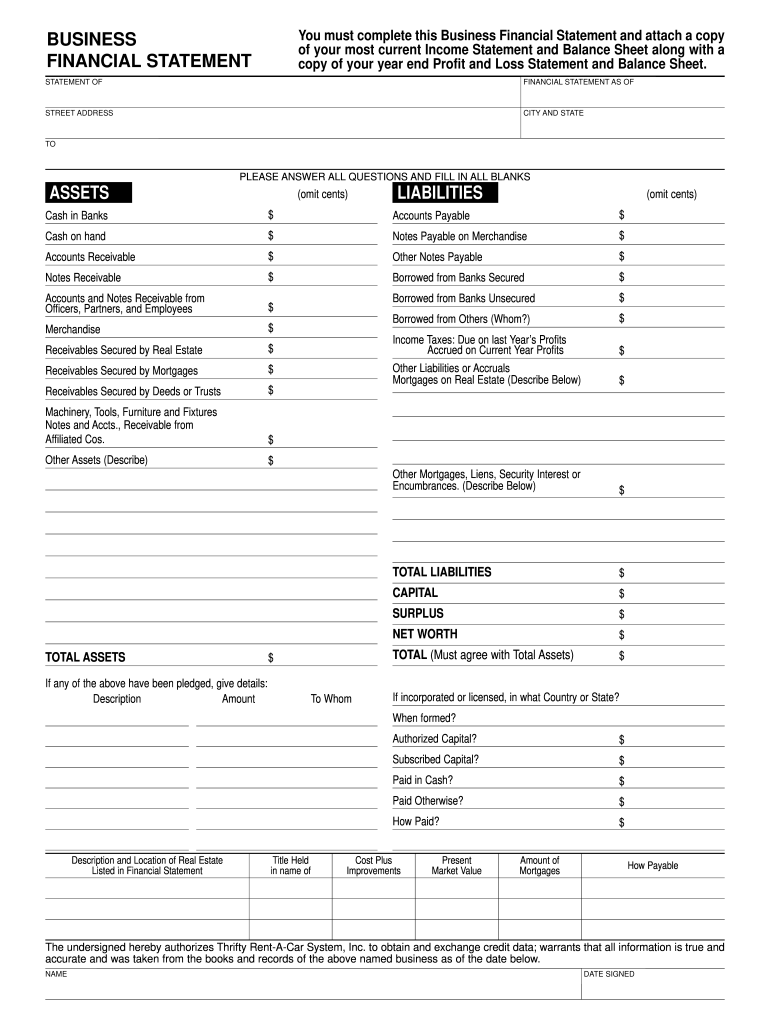

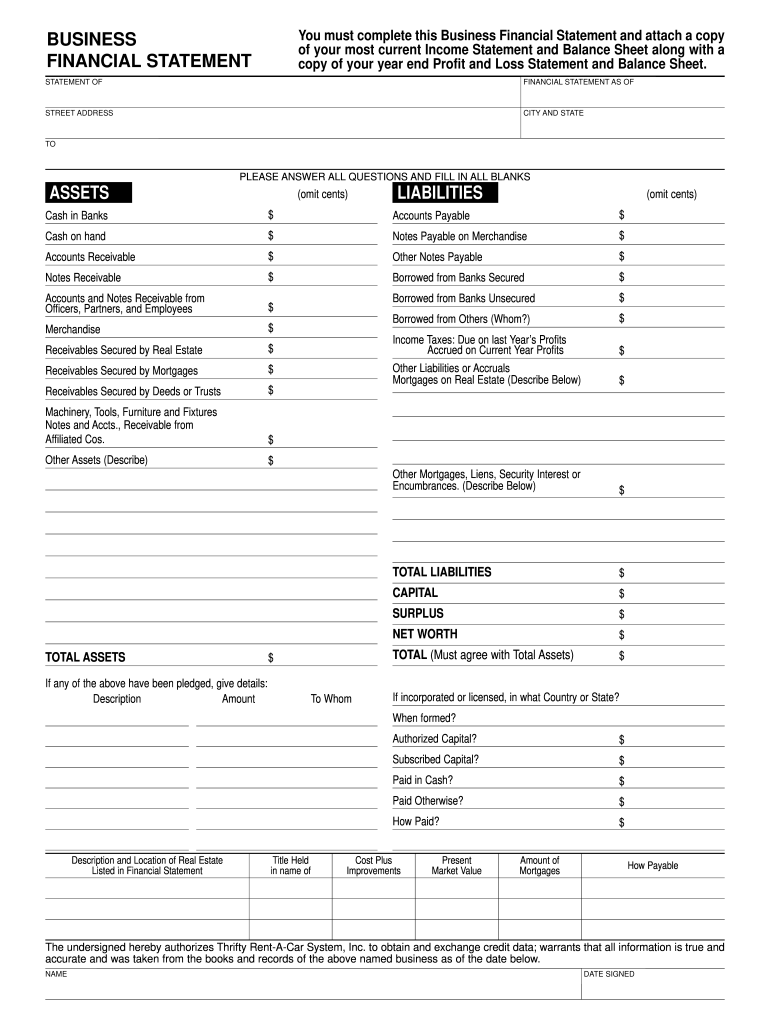

Thrifty Car Rental Business Financial Statement free printable template

Show details

You must complete this Business Financial Statement and attach a copy of your most current Income Statement and Balance Sheet along with a copy of your year-end Profit and Loss Statement and Balance

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign business financial statement template form

Edit your financial report template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statement for small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual financial statement template online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit blank financial statement to print form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business financial statement template form

How to fill out Thrifty Car Rental Business Financial Statement

01

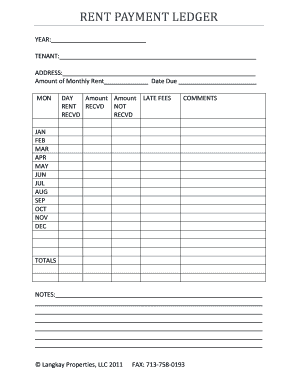

Gather all necessary financial documents, including income statements, balance sheets, and cash flow statements.

02

Begin with the identification section, including the business name, address, and contact information.

03

Enter the reporting period for which the financial statement is created.

04

Fill in the revenue section by listing all sources of income, such as rental fees and additional services.

05

Include all expenses, categorizing them into operating expenses, administrative costs, and any other relevant costs.

06

Calculate the net income by subtracting total expenses from total revenue.

07

Complete the asset section by listing all current and fixed assets owned by the business.

08

Document liabilities by listing outstanding debts and obligations.

09

Ensure that all numbers are accurate and aligned with supporting documents.

10

Review the final statement for clarity and correctness before submission or presentation.

Who needs Thrifty Car Rental Business Financial Statement?

01

Business owners of Thrifty Car Rental for financial analysis and planning.

02

Investors looking to assess the financial health of the business.

03

Lenders requiring financial statements for loan applications.

04

Regulatory agencies for compliance and verification purposes.

05

Potential partners or acquirers seeking detailed financial information.

Fill

statement editor

: Try Risk Free

People Also Ask about business financial statement pdf

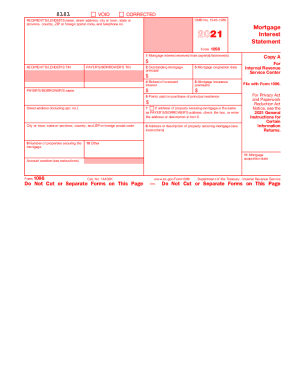

What are the basic financial statements?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

What is included in a business financial statement?

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues and costs, as well as its cash flows from operating, investing, and financing activities.

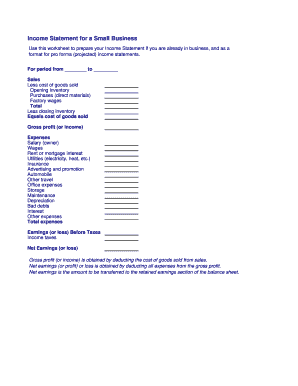

What is the best financial statement for a small business?

“The cash flow statement is the most critical financial report because it's vital in seeing the big picture. It summarizes all cash inflows and cash outflows of a business over a certain period, providing details where the money is spent and indicates if the business is generating enough cash or not.

What are the five 5 basic financial statements?

Here's why these five financial documents are essential to your small business. The five key documents include your profit and loss statement, balance sheet, cash-flow statement, tax return, and aging reports.

What are the 5 major accounts?

The 5 primary account categories are assets, liabilities, equity, expenses, and income (revenue)

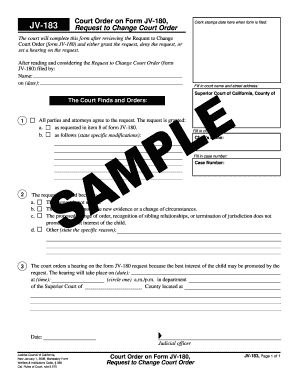

How do you prepare a business financial statement?

How to Prepare Financial Statements Step 1: Verify Receipt of Supplier Invoices. Step 2: Verify Issuance of Customer Invoices. Step 3: Accrue Unpaid Wages. Step 4: Calculate Depreciation. Step 5: Value Inventory. Step 6: Reconcile Bank Accounts. Step 7: Post Account Balances. Step 8: Review Accounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial statements templates in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your editable financial statement and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send small business financial statements examples pdf to be eSigned by others?

When you're ready to share your pdffiller, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the 100111786 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your for profit businesses use four primary types of flow and the statement of retained earnings text these three statements together show the assets and you'll be done in minutes.

What is Thrifty Car Rental Business Financial Statement?

The Thrifty Car Rental Business Financial Statement is a financial document that outlines the financial performance and position of the Thrifty Car Rental business, including income, expenses, assets, and liabilities.

Who is required to file Thrifty Car Rental Business Financial Statement?

Typically, business owners or operators of Thrifty Car Rental franchises are required to file the financial statement, particularly for tax purposes or if seeking financing.

How to fill out Thrifty Car Rental Business Financial Statement?

To fill out the Thrifty Car Rental Business Financial Statement, gather necessary financial data, including income and expenses, and follow the prescribed format to accurately enter figures under the relevant sections.

What is the purpose of Thrifty Car Rental Business Financial Statement?

The purpose of the Thrifty Car Rental Business Financial Statement is to provide a clear representation of the business's financial health, aiding in decision-making for management, investors, and regulatory bodies.

What information must be reported on Thrifty Car Rental Business Financial Statement?

The information that must be reported includes revenues, operating expenses, net income, assets, liabilities, equity, and any other relevant financial transactions that reflect the business's performance.

Fill out your Thrifty Car Rental Business Financial Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Format Of A Financial Statement is not the form you're looking for?Search for another form here.

Keywords relevant to business financial statements template

Related to small business financial statement sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.